Total compliance confidence for alcohol shipping & distribution

Sovos ShipCompliant powers the nation’s leading wineries, distilleries, breweries, importers and retailers to manage complex state regulations, automate tax calculation, and ensure compliance for all aspects of alcohol distribution and direct shipping.

- 50 State Compliance Coverage

- Real-Time Compliance Checks

- Label & License Management

- Rooftop-Level Tax Calculation

“With ShipCompliant, we eliminated compliance bottlenecks and scaled DtC shipments without risking state violations. It’s become the backbone of our operations.”

Director of Compliance

Leading California Winery

Regulations evolve constantly — your shipping compliance must too

Every state has different rules for licensing, reporting, and taxation. One missed renewal or unreported shipment can mean costly fines or revoked privileges. Manual spreadsheets and fragmented systems can’t keep up with changing requirements.

Sovos ShipCompliant centralizes everything — giving you real-time visibility, automated tax calculation, and peace of mind on every shipment.

Single system for DtC and three-tier shipping compliance across all states

Real-time tax determination and accurate filing for every transaction

Integrated license and label registration management to avoid shipment holds

Automated reporting and state form submission to reduce manual work

Flexible integrations with commerce, fulfillment, and ERP systems

Everything compliance needs—connected, automated, secure

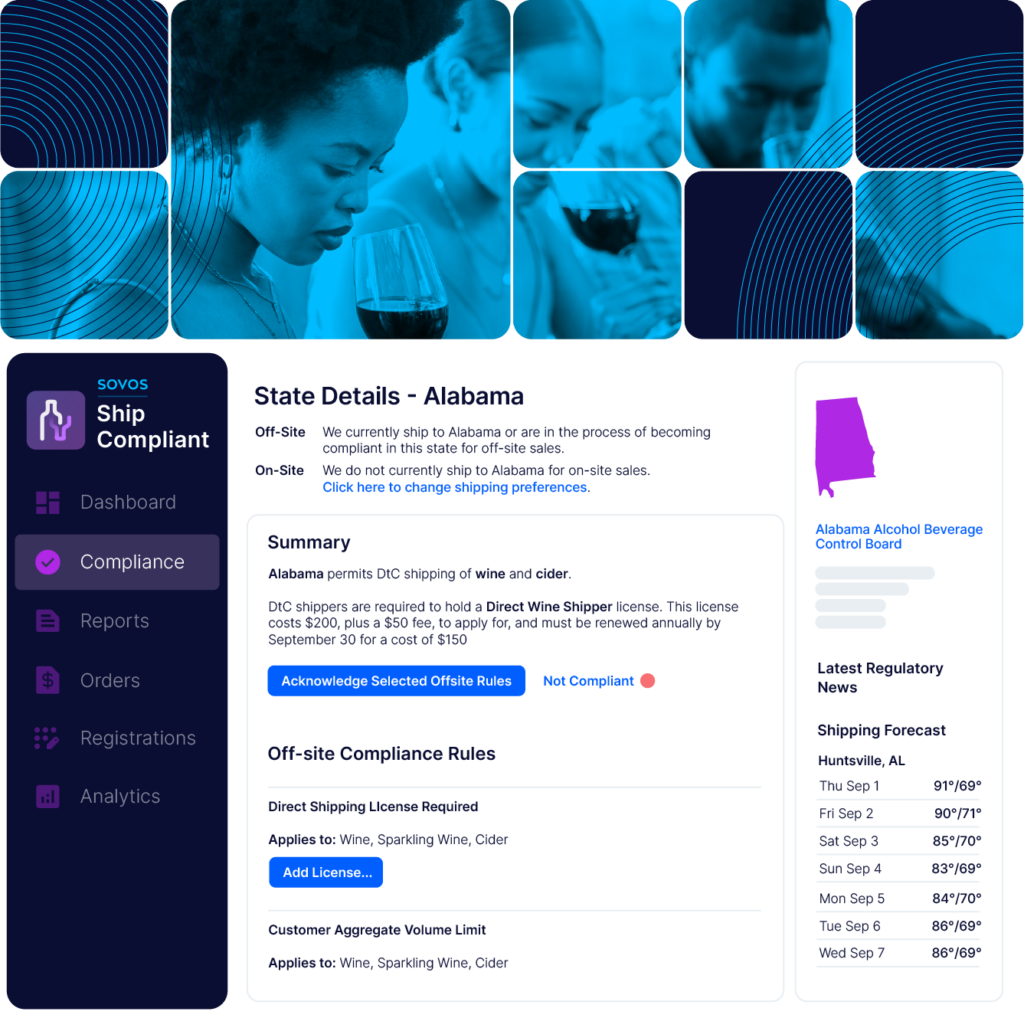

Comprehensive State Compliance

Know the rules for each state before you ship. ShipCompliant automatically validates licenses, tax rates and volume limits.

Tax Calculation & Reporting

License & Label Management

DtC & Three-Tier Support

Integration & Automation

Audit Trail & Visibility

FAQ: Answers to global compliance questions

How does ShipCompliant help avoid state fines?

It automatically checks licenses, volume limits and destination restrictions before you ship, flagging issues in real time so violations don’t happen.

Can it support both DtC and three-tier models?

Yes — the platform manages tax rules and reporting requirements for both sales channels in a single workflow.

Does it integrate with our commerce and fulfillment systems?

ShipCompliant integrates with leading e-commerce and logistics solutions, synchronizing orders, shipping data and tax records automatically.

How are tax rates kept up to date?

Our regulatory team monitors state and local rule changes daily and updates rates and forms directly in the system.

Who uses ShipCompliant today?

Over 2 000 wineries, distilleries, importers and marketplaces trust Sovos ShipCompliant to ship with confidence across all 50 states.

Take the complexity Global compliance, one intelligent platform

Automate compliance, reduce risk, and reclaim time for strategic work.