Stay compliant across Latin America — confidently and consistently

Manage e-invoicing, VAT, and digital reporting across Mexico, Peru, Chile, Colombia, Costa Rica, and Ecuador in one platform. The Sovos Indirect Tax Suite automates mandates, keeps pace with every change, and ensures compliance without slowing your business.

- e-Invoicing Mandates Covered

- Local Support in 6 Countries

- ERP Integration

- Continuous Regulatory Updates

“Sovos helped us standardize e-invoicing and VAT control across six countries, cutting errors and giving us faster response times to tax authorities.”

Regional Tax Director

Multinational Consumer Goods Company

Every country. Every change. Every day

Latin America leads the world in real-time tax enforcement. Each country has its own schemas, portals, and clearance rules — and they change constantly. Manual updates and regional point solutions can’t keep up.

Sovos delivers one connected compliance platform that keeps you ahead of every new e-invoicing, VAT, and reporting mandate across the region.

End-to-end e-invoicing, VAT, and reporting coverage for Mexico, Chile, Peru, Colombia, Costa Rica, and Ecuador

Automatic updates for schema, format, and rule changes from local tax authorities

Seamless integration with SAP, Oracle, Microsoft, and local ERPs

Real-time validation and submission to SAT, SII, SUNAT, DIAN, DGT, and SRI

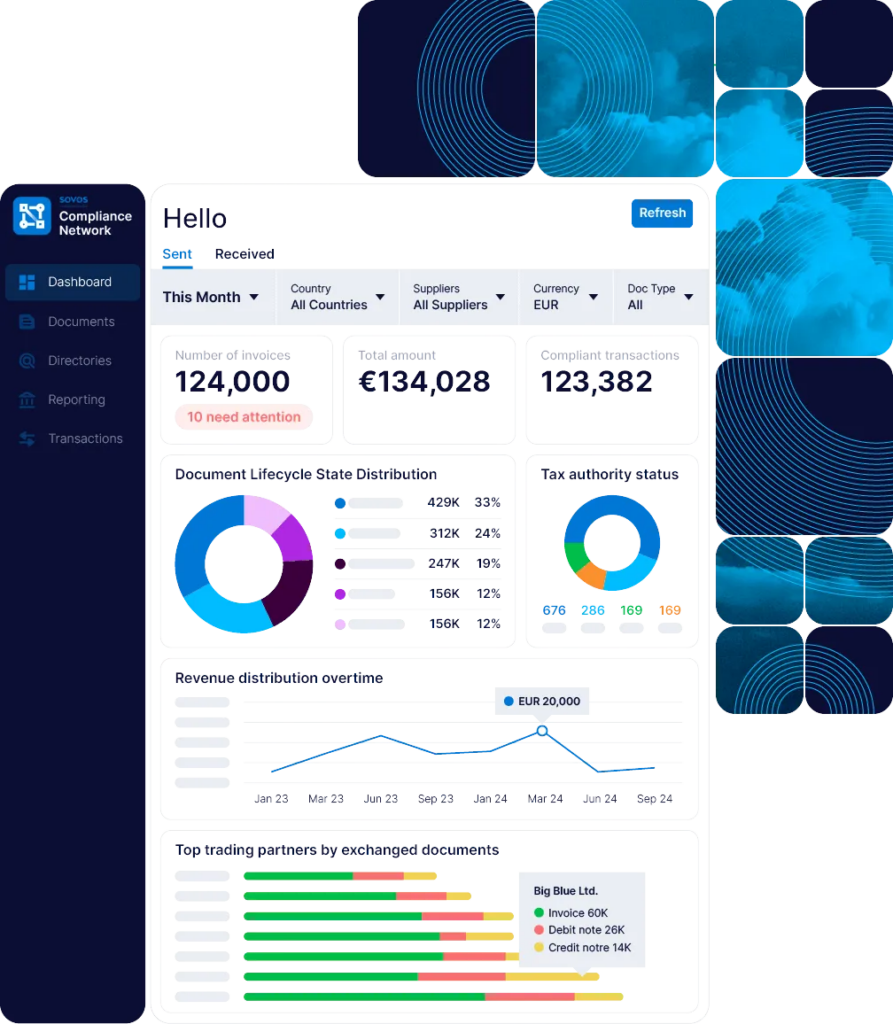

Consolidated dashboards to monitor filings across all countries and entities

One platform. Regional coverage. Continuous compliance

E-Invoicing Automation

Automated VAT Determination

Real-Time Monitoring & Analytics

Continuous Regulatory Updates

Enterprise Integrations & Scalability

Regional Support & Local Expertise

FAQ: Answers to common LATAM compliance questions

How does Sovos stay current with changing rules?

Can I use the solution for multiple countries?

Does it integrate with our existing ERP?

How secure is the platform?

How fast can we go live?

Take the complexity Stay compliant across Latin America

Automate compliance, reduce risk, and reclaim time for strategic work.