Stay ahead of every e-invoicing and VAT change across EMEA

From France to Poland, Turkey to the UK — Sovos helps multinational businesses comply with evolving digital-tax mandates. The Sovos Indirect Tax Suite automates e-invoicing, VAT reporting, and cross-border compliance in one intelligent platform.

- Clearance & Post-Audit Models

- ERP Integration

- Continuous Regulatory Updates

- SOC 2 Certified

“Sovos keeps us compliant across Europe’s fast-changing VAT landscape. Their automated updates and seamless ERP integration have saved us weeks of manual work.”

Head of Indirect Tax

Europe’s VAT landscape is changing fast — are you ready?

New e-invoicing, SAF-T, and real-time reporting mandates are rolling out across EMEA. Local solutions can’t scale, and manual processes can’t keep up with shifting schemas and deadlines.

Sovos provides a single, continuously updated platform that ensures compliance in every country — now and as new mandates arrive.

Full e-invoicing and VAT-reporting coverage for the UK, France, Italy, Spain, Germany, Poland, Portugal, Turkey and beyond

Always-up-to-date regulatory logic aligned with ViDA and local digital-reporting requirements

Automated validation, submission, and reconciliation for all clearance and post-audit models

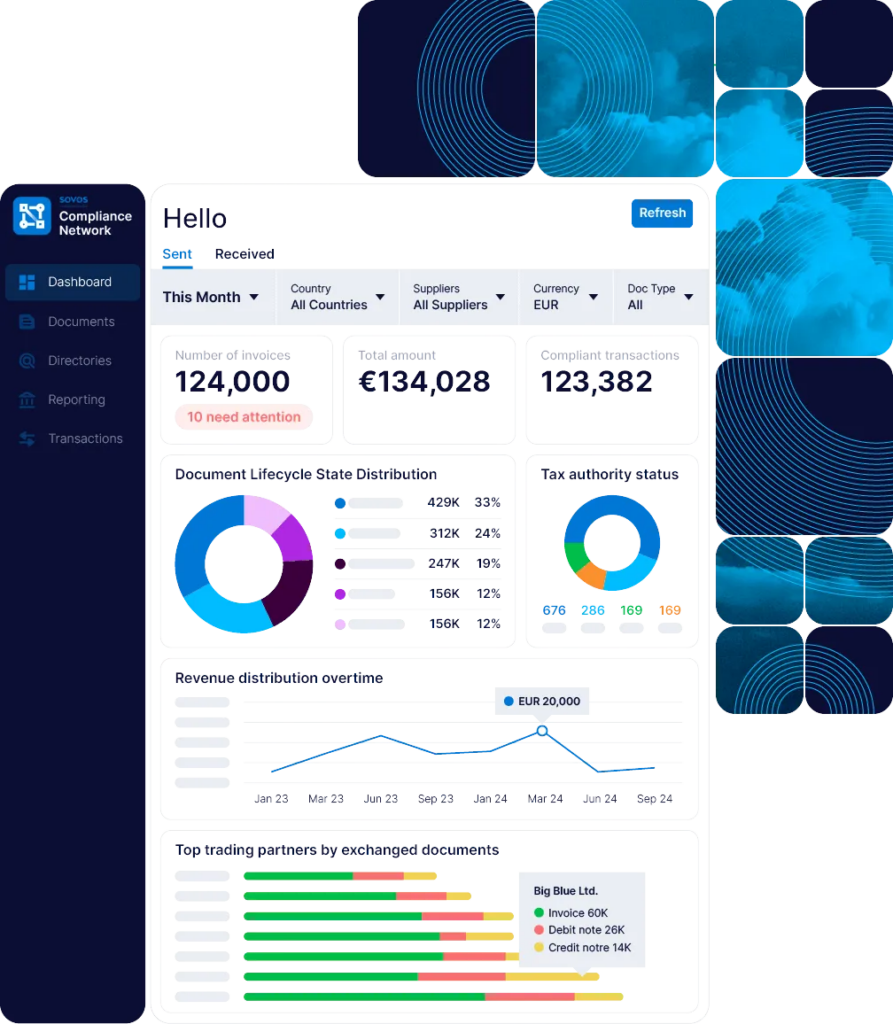

Built-in analytics to detect anomalies before authorities do

Native integrations with SAP, Oracle, and leading finance systems

One platform for all your indirect-tax obligations

Automated E-Invoicing Compliance

VAT Determination & Reporting

Continuous Transaction Controls

Real-Time Monitoring & Analytics

Integration & Scalability

Security & Data Residency

FAQ: Answers to common EMEA compliance questions

How does Sovos stay current with every country’s mandates?

Sovos’ regulatory team tracks thousands of updates across EMEA and automatically applies schema and filing changes to the platform.

Can the solution handle multiple VAT regimes and languages?

How does it integrate with our ERP landscape?

Does it cover ViDA and upcoming EU e-invoicing reforms?

How secure is the platform?

Take the complexity Stay ahead of every e-invoicing and VAT change across EMEA

Automate compliance, reduce risk, and reclaim time for strategic work.