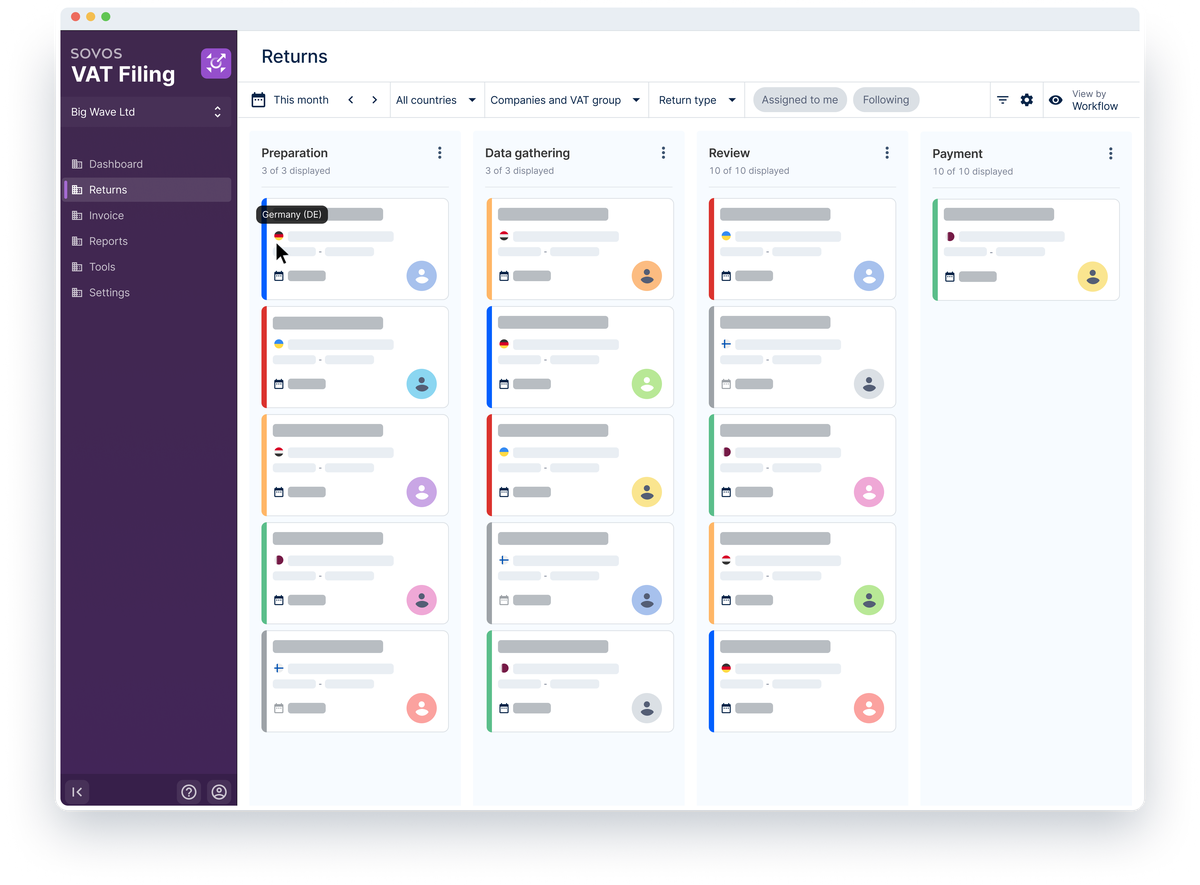

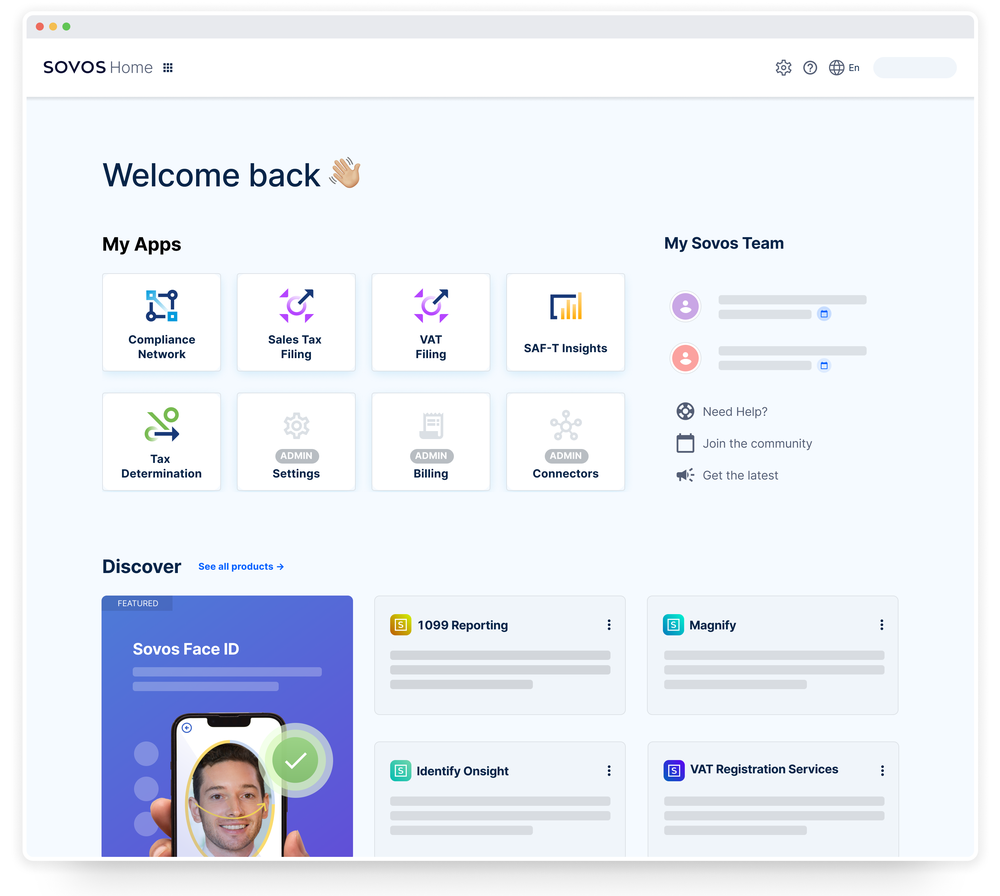

Make Sovos your core tax technology and always stay ahead of changing global regulations

As more governments around the world look to close the tax gap, they’re requiring businesses to report on their tax obligations in real-time, or at a more frequent cadence than ever before. Addressing each tax and compliance obligation in isolation can increase cost and risk.

The Sovos Indirect Tax Suite is designed to empower global enterprises to manage indirect tax obligations with any government, buyer, supplier or consumer, all in one place.