One Sentence Value Prop

Ensure Seamless Compliance Across Jurisdictions Regulatory changes happen fast. Sovos keeps you ahead of evolving tax requirements with automated updates and real-time compliance monitoring.

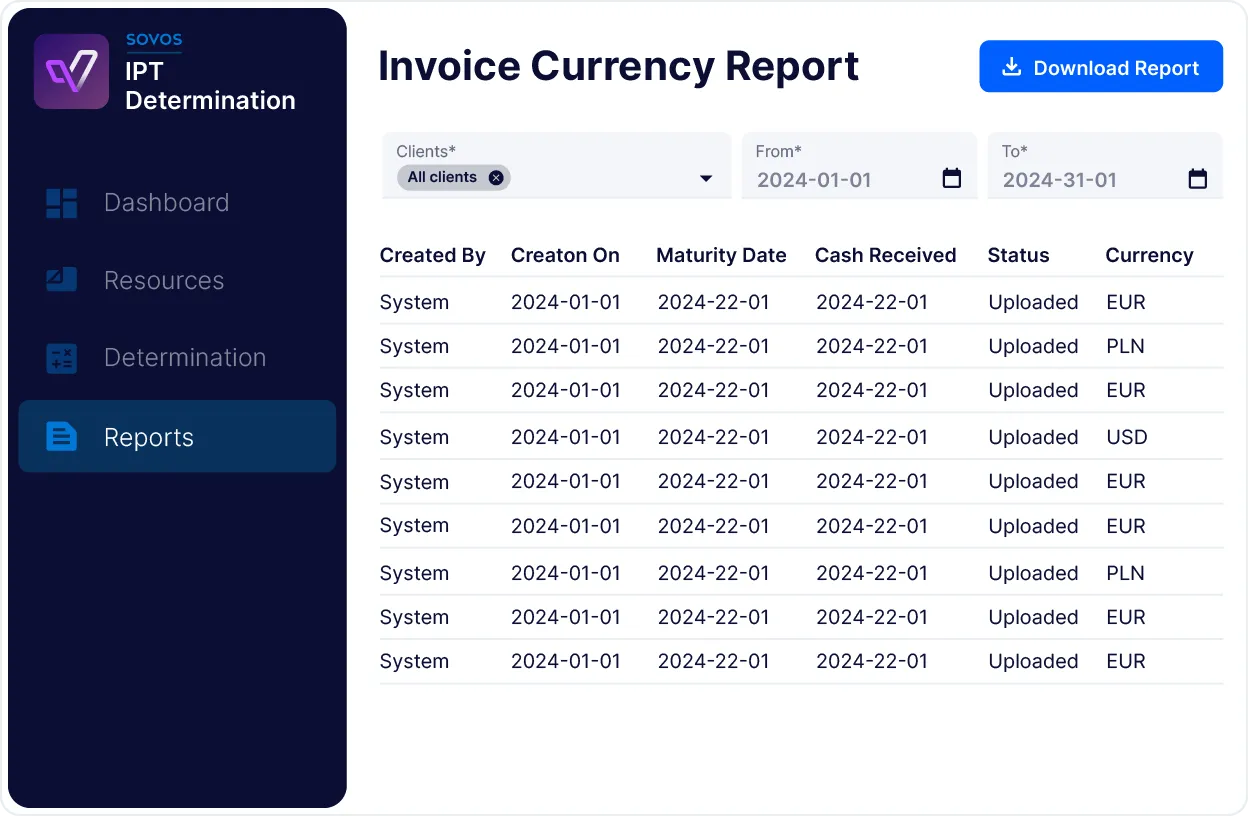

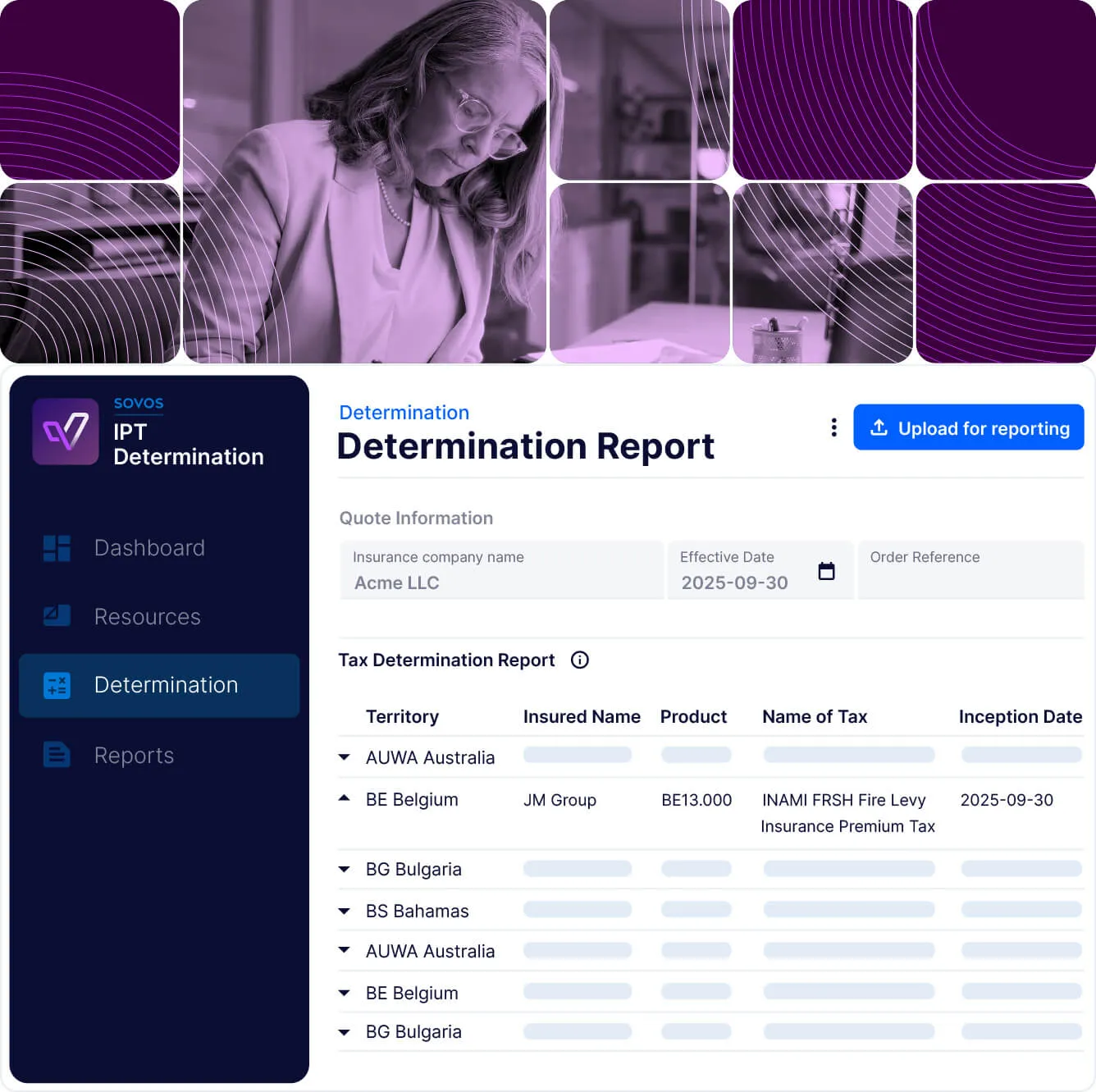

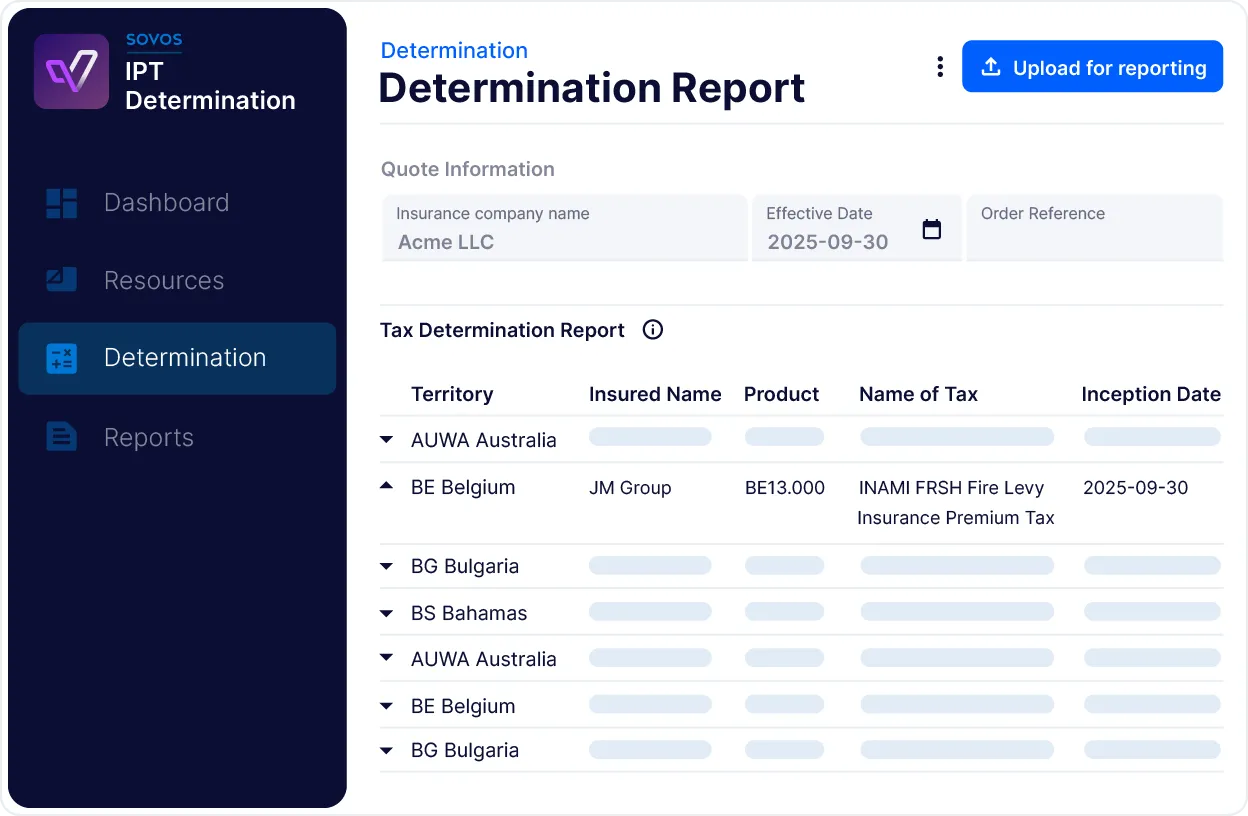

Sovos IPT Determination

Managing Insurance Premium Tax (IPT) compliance is complex due to varying tax rates, regulations, and exemptions across jurisdictions. Sovos IPT Determination simplifies tax calculation and reporting, ensuring accuracy, automation, and compliance for insurers operating in multiple regions.

Ensure Seamless Compliance Across Jurisdictions Regulatory changes happen fast. Sovos keeps you ahead of evolving tax requirements with automated updates and real-time compliance monitoring.

Sovos IPT Determination

Supports IPT compliance across multiple jurisdictions with automated tax rate updates.

Reduces human error and ensures precise tax calculations.

Leading insurers rely on Sovos for end-to-end IPT compliance management.

Navigating IPT regulations requires precision. Sovos automates tax rate determination and ensures compliance across multiple jurisdictions, reducing manual errors and risks.

Automatically applies the correct IPT rates based on jurisdiction-specific regulations and policy details.

Ensures compliance by instantly incorporating the latest tax rate changes and regulatory updates.

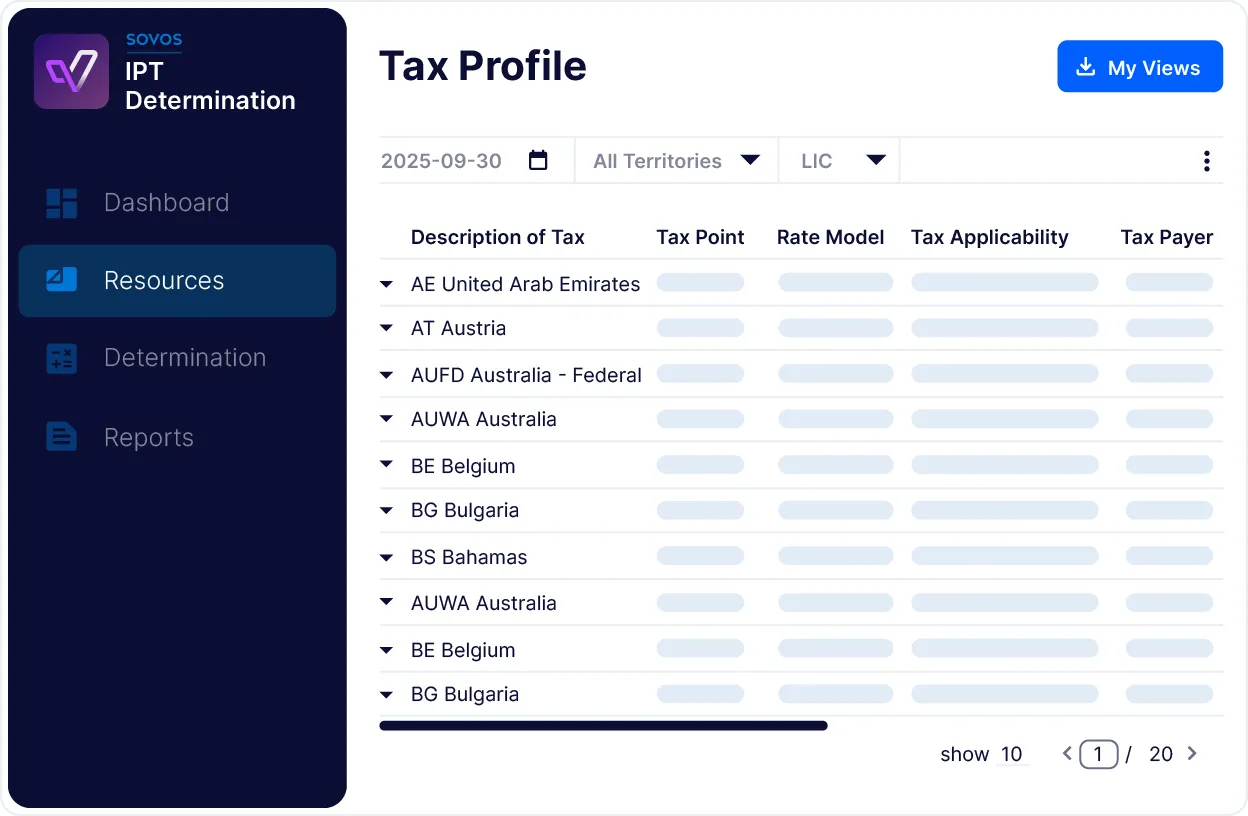

Provides a single view to manage IPT compliance across multiple countries and tax authorities.

Manual tax calculations expose insurers to compliance risks. Sovos automates IPT calculations and reporting, ensuring accuracy and minimizing administrative burden.

Enhances accuracy by validating tax data and maintaining detailed audit logs for compliance tracking.

Simplifies compliance by submitting IPT filings directly to tax authorities through secure digital channels.

Identifies potential filing errors and compliance risks instantly, preventing costly penalties.

Sovos IPT Determination integrates with core insurance policy and billing systems, ensuring smooth, accurate tax determination without disrupting operations.

Seamlessly connects with insurance systems to automate IPT determination within existing workflows.

Adapts to business growth with a secure, cloud-based platform designed for global IPT compliance.

Tailors IPT determination and reporting workflows to align with unique business and regulatory requirements.