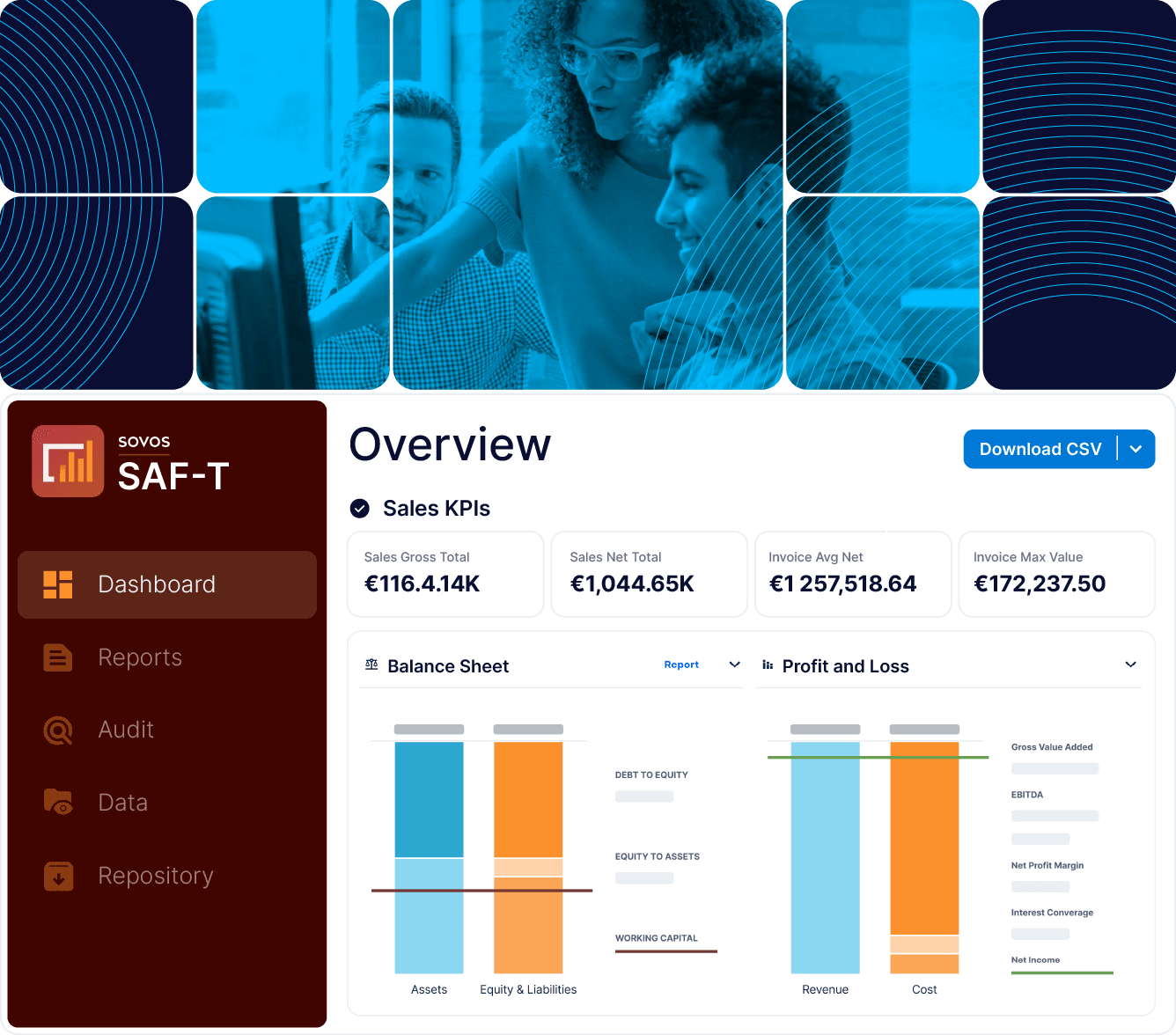

Automate the process of preparing robust, accurate and compliant SAF-T files

Extract

Automatically extract financial and transactional data from your ERP systems. Capture all required information in real-time without disrupting daily operations.

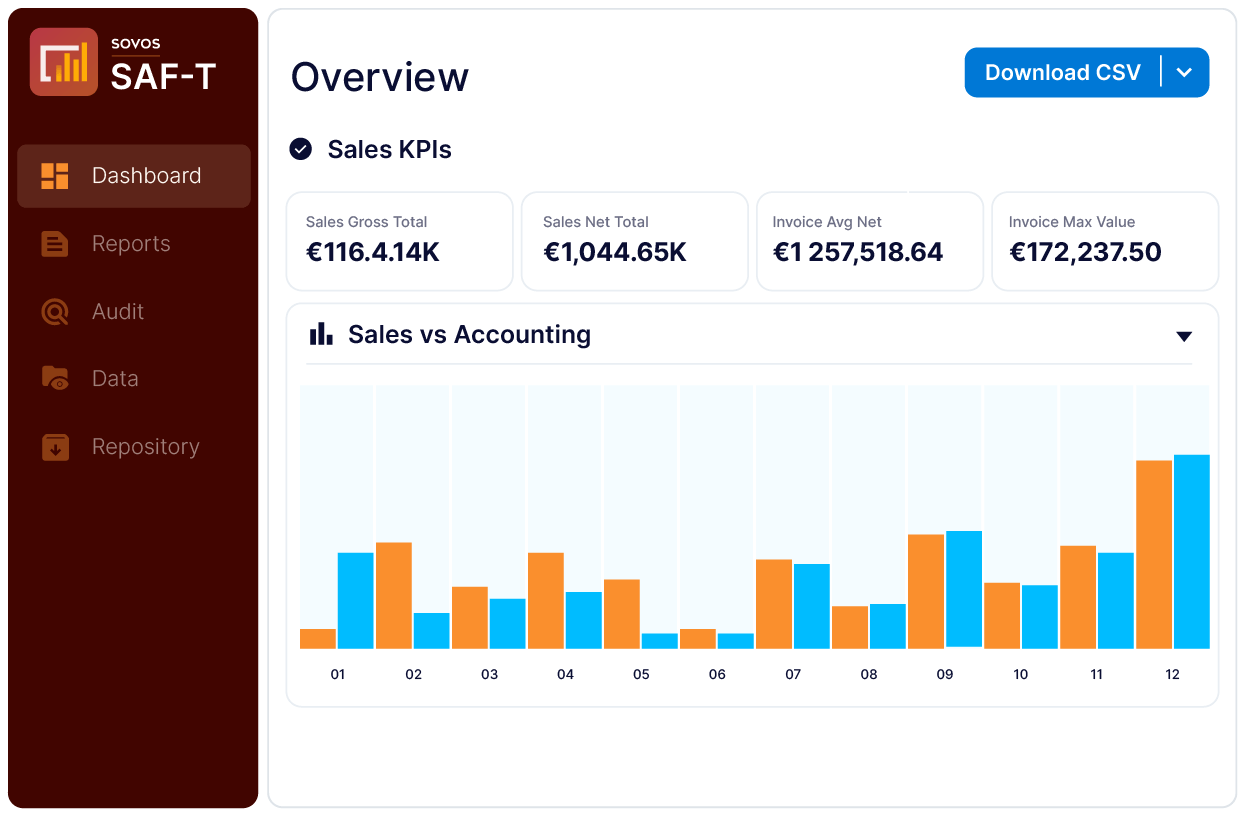

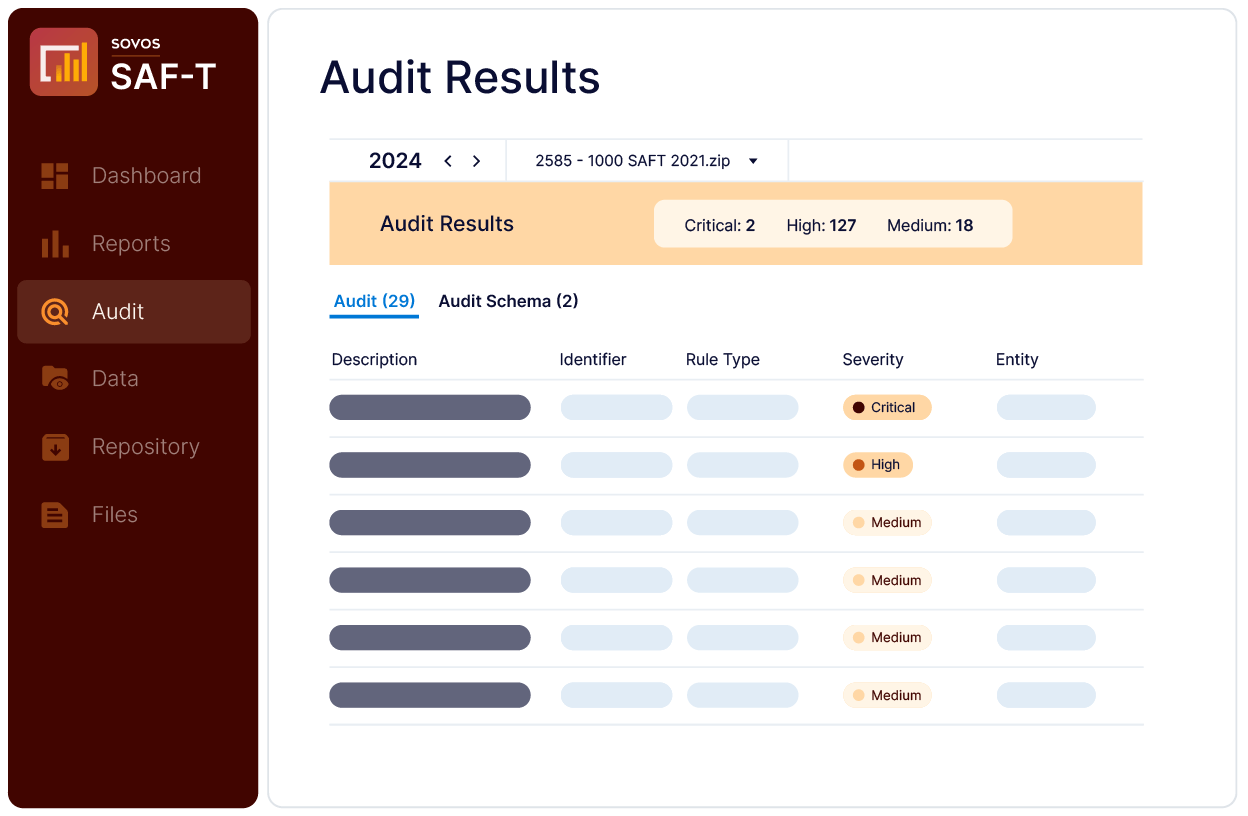

Analyze

Validate data to identify inconsistencies or missing information. Ensure accuracy and compliance with country-specific SAF-T requirements.

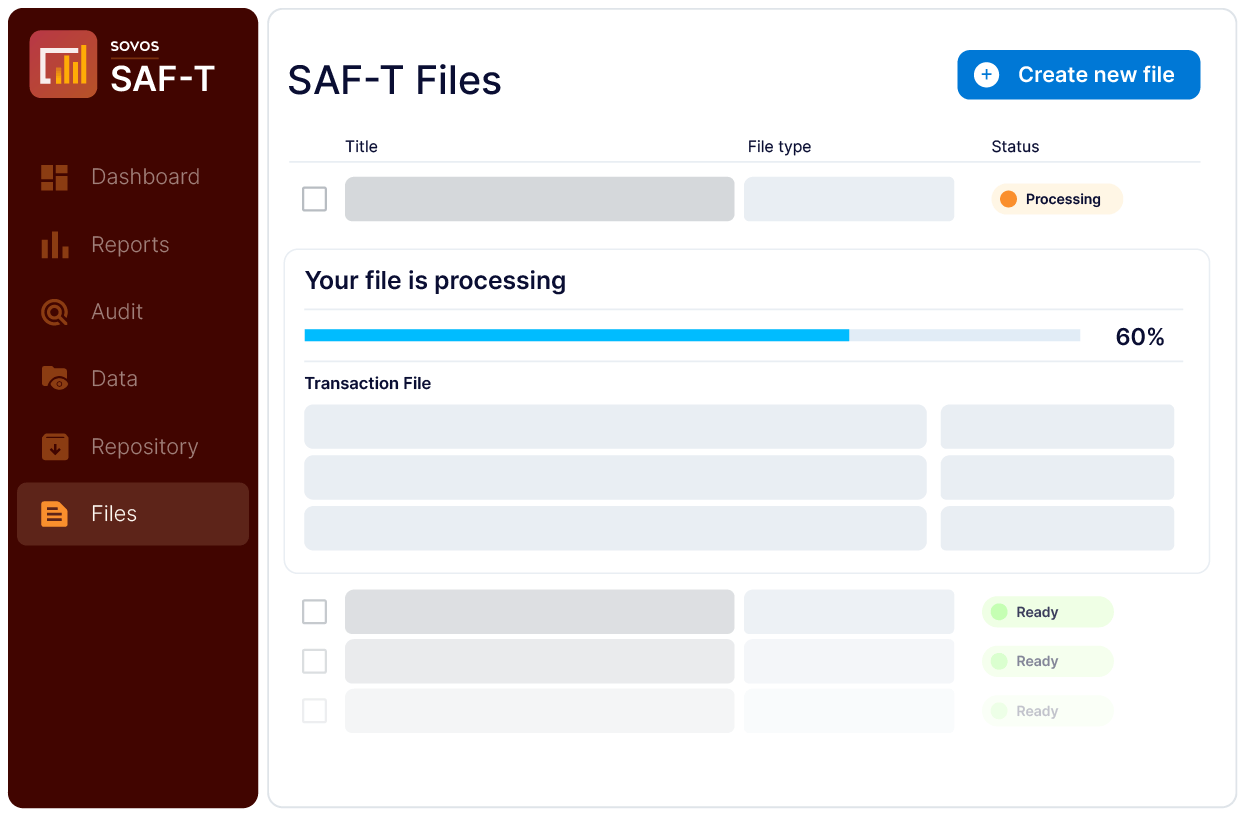

Generate

Create error-free SAF-T files in the correct format for submission to tax authorities. Guarantee compliance with local regulations and submission mandates.