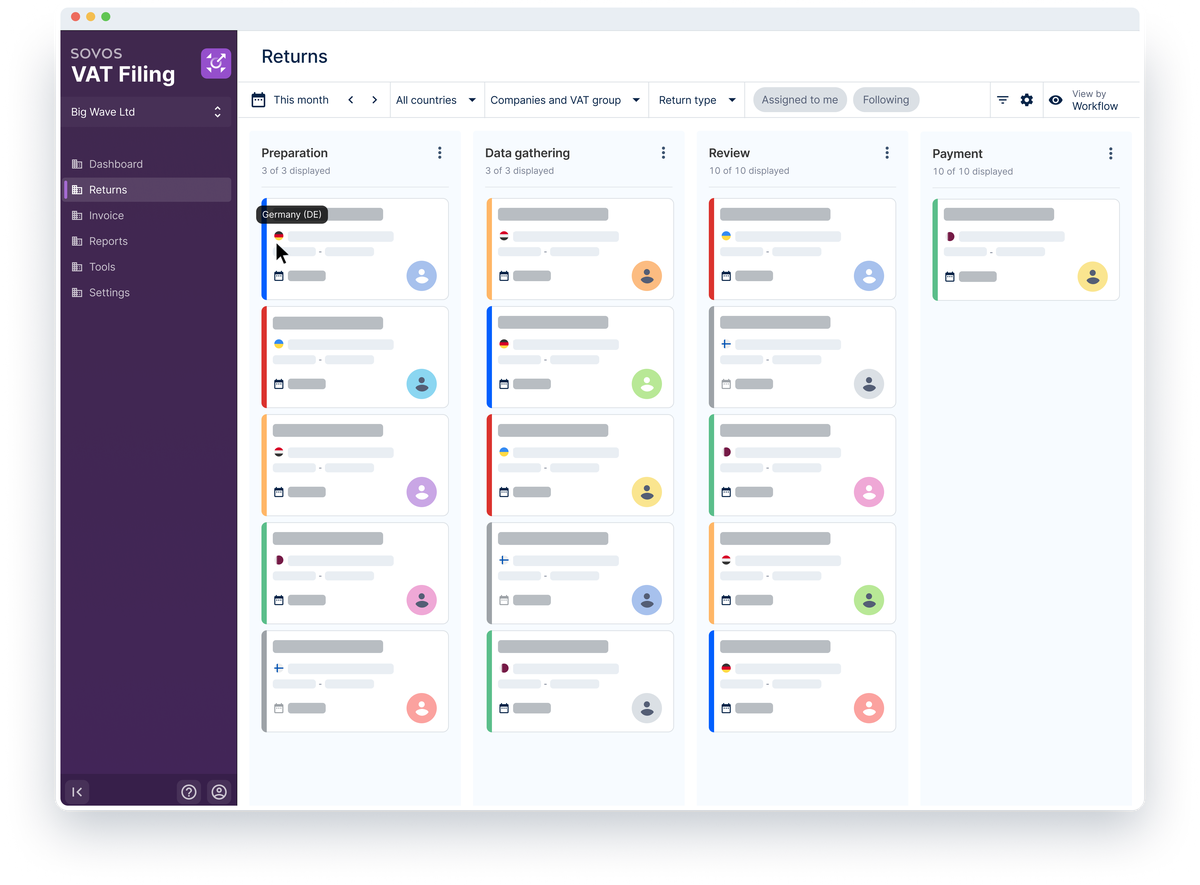

Ready Today, Future-Proof for Tomorrow

The tax compliance landscape is evolving rapidly, driven by digital transformation, regulatory changes, and the growing demand for real-time reporting and automation.

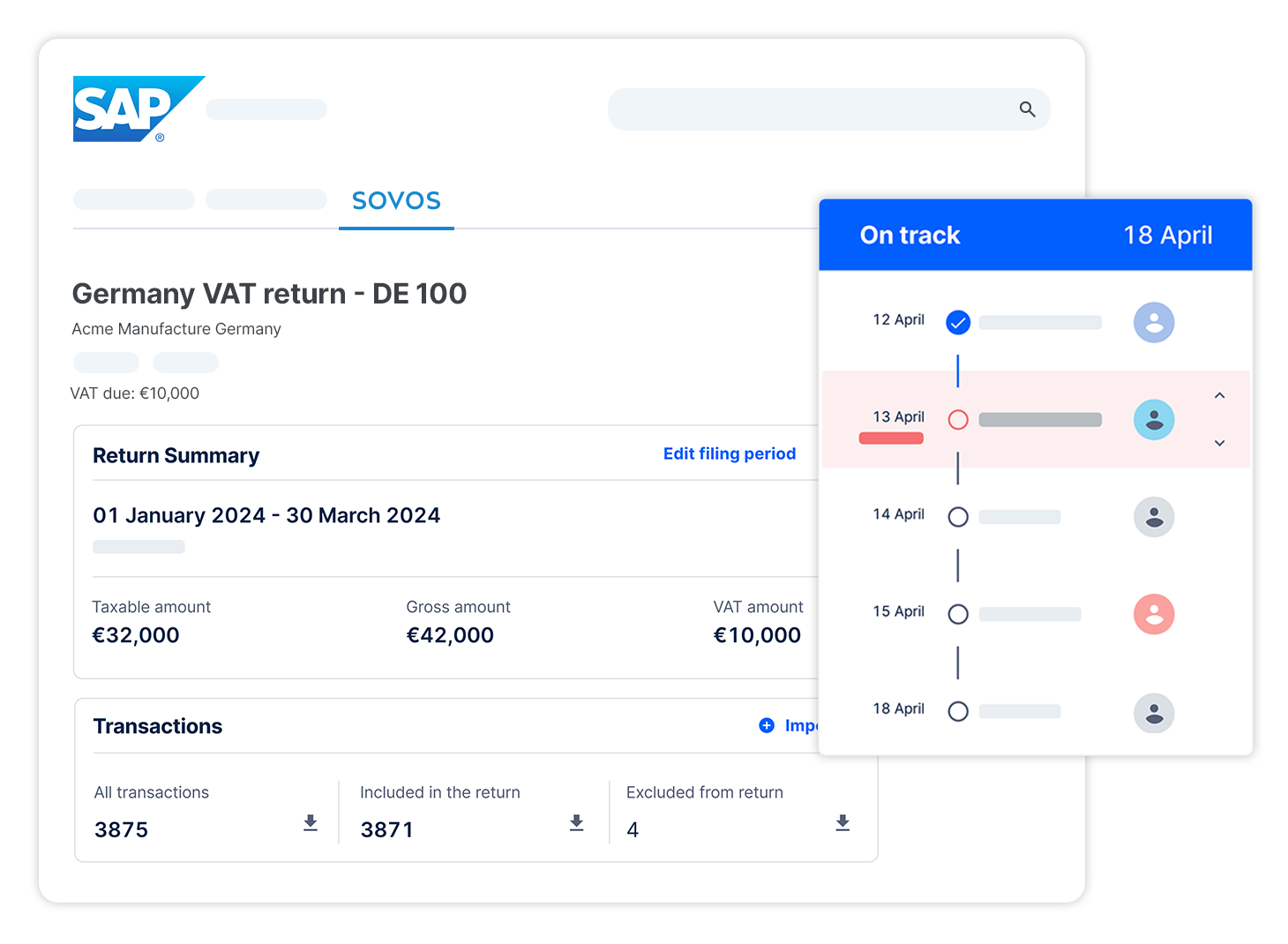

With deep expertise in global tax regulations and a future-ready approach aligned with SAP’s Clean Core strategy, Sovos empowers companies to simplify compliance, reduce risks, and scale operations efficiently. Whether your business is transitioning to S/4HANA or staying with ECC, Sovos offers the most reliable tax compliance solution available today.