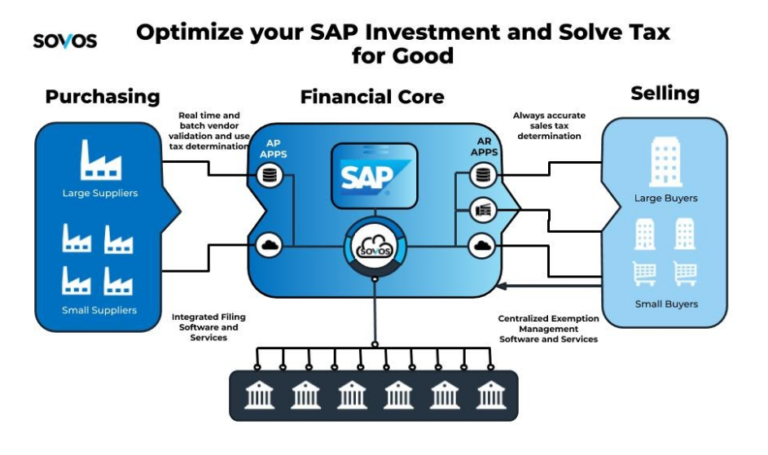

Leading companies in the manufacturing, retail, pharmaceutical, distribution and services industries using SAP, rely on Sovos to ensure simple accurate tax determination, comprehensive and automated sales tax exemptions, and complete filing services.

Sovos has partnered with SAP for over 20 years, offering the following benefits:

- End-to-end sales tax processes: From sales tax calculations to procurement, you’ll get a comprehensive set of solutions to manage your sales tax process from start to finish.

- Centralize your sales tax systems: Consolidate your sales tax reporting and provide visibility to senior leadership.

- Empower your tax/finance teams: Provide employees access to more streamlined sales tax solutions, reducing their reliance on IT to increase efficiencies and minimize the substantial risk of non compliance.

- Drive value-led finance transformation: Enable the power of real-time data to provide accurate & high-quality insights to your sales tax reporting.