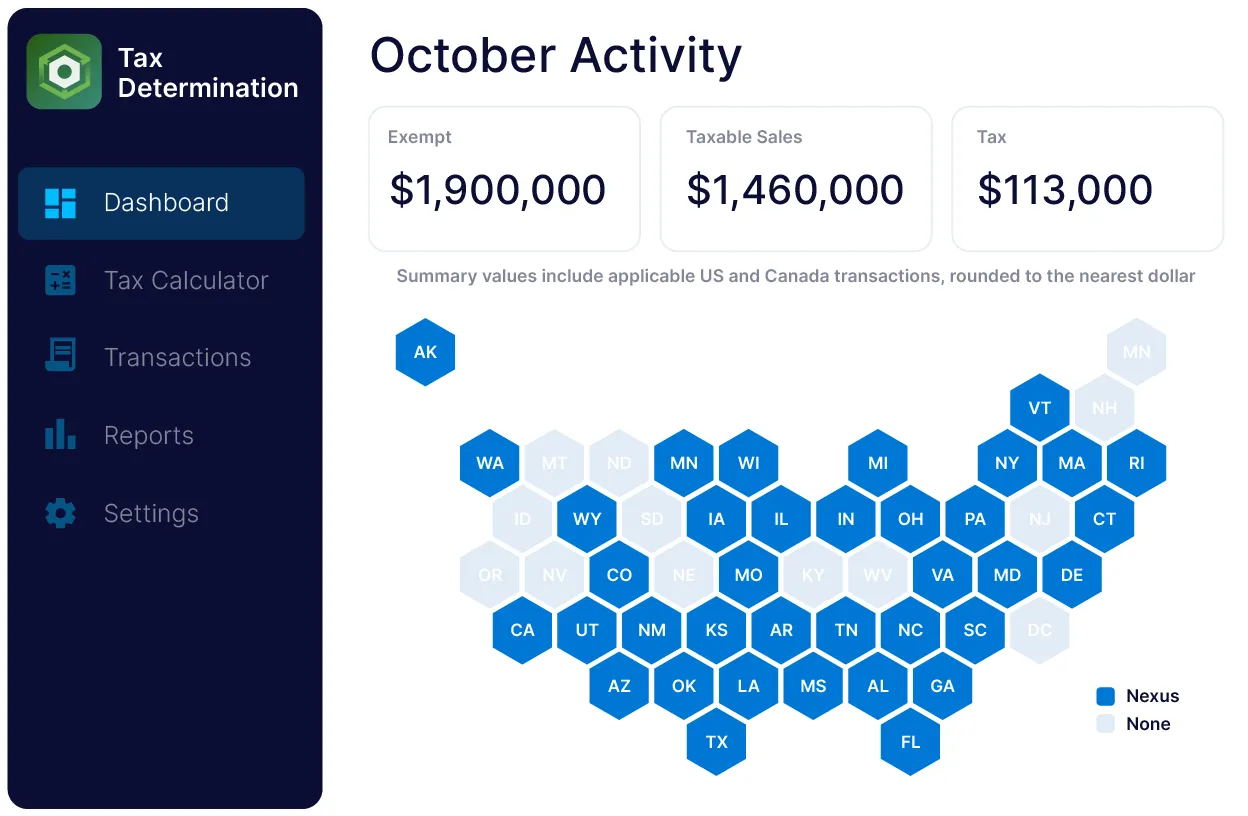

Why Sovos Tax Determination – SUT?

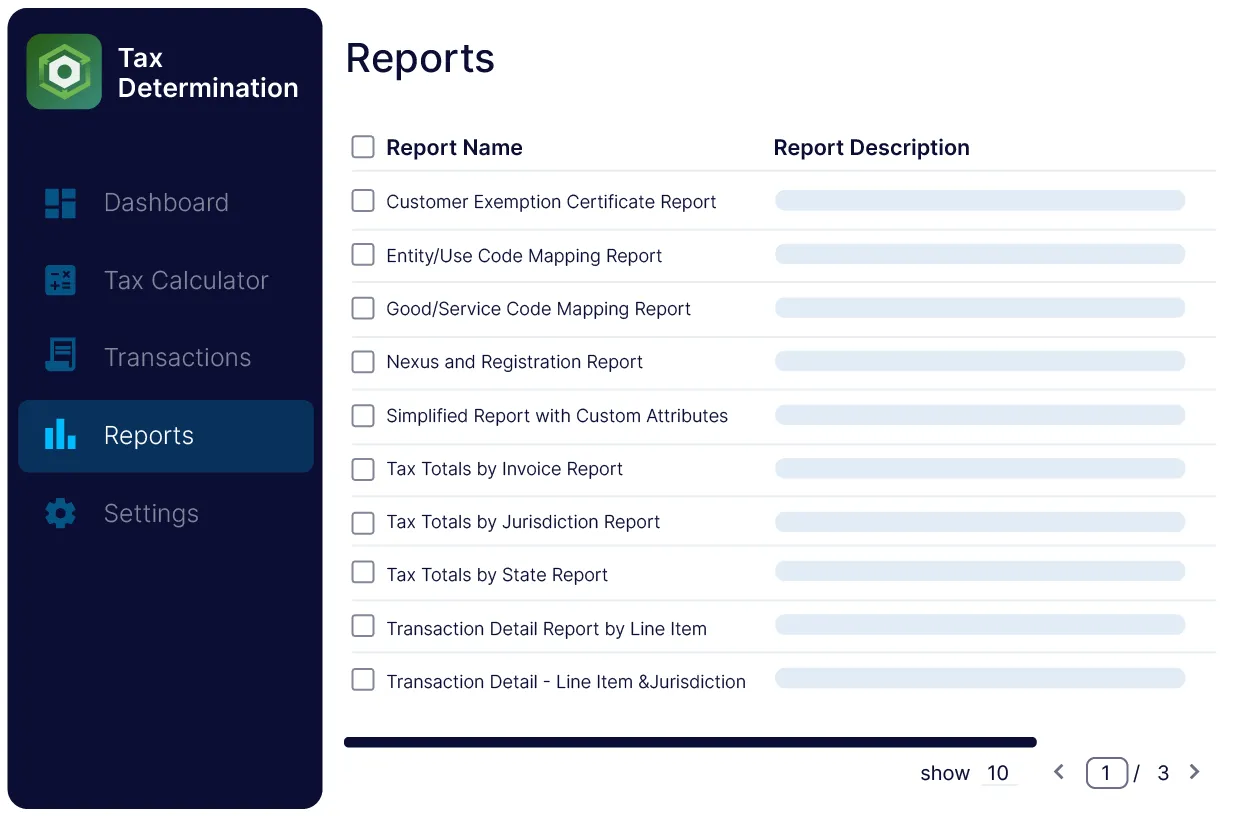

Multi-Jurisdictional Tax Filing

Stay compliant across state, local, and international tax regulations.

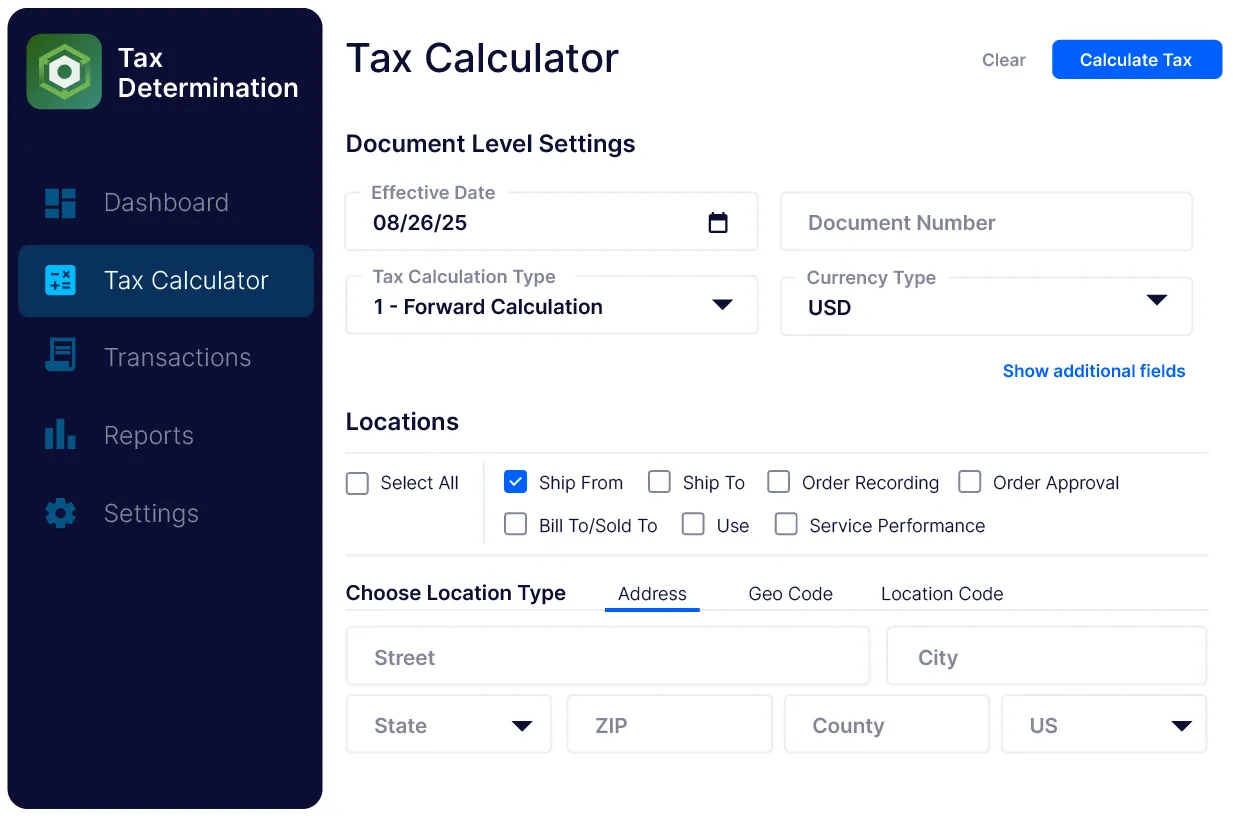

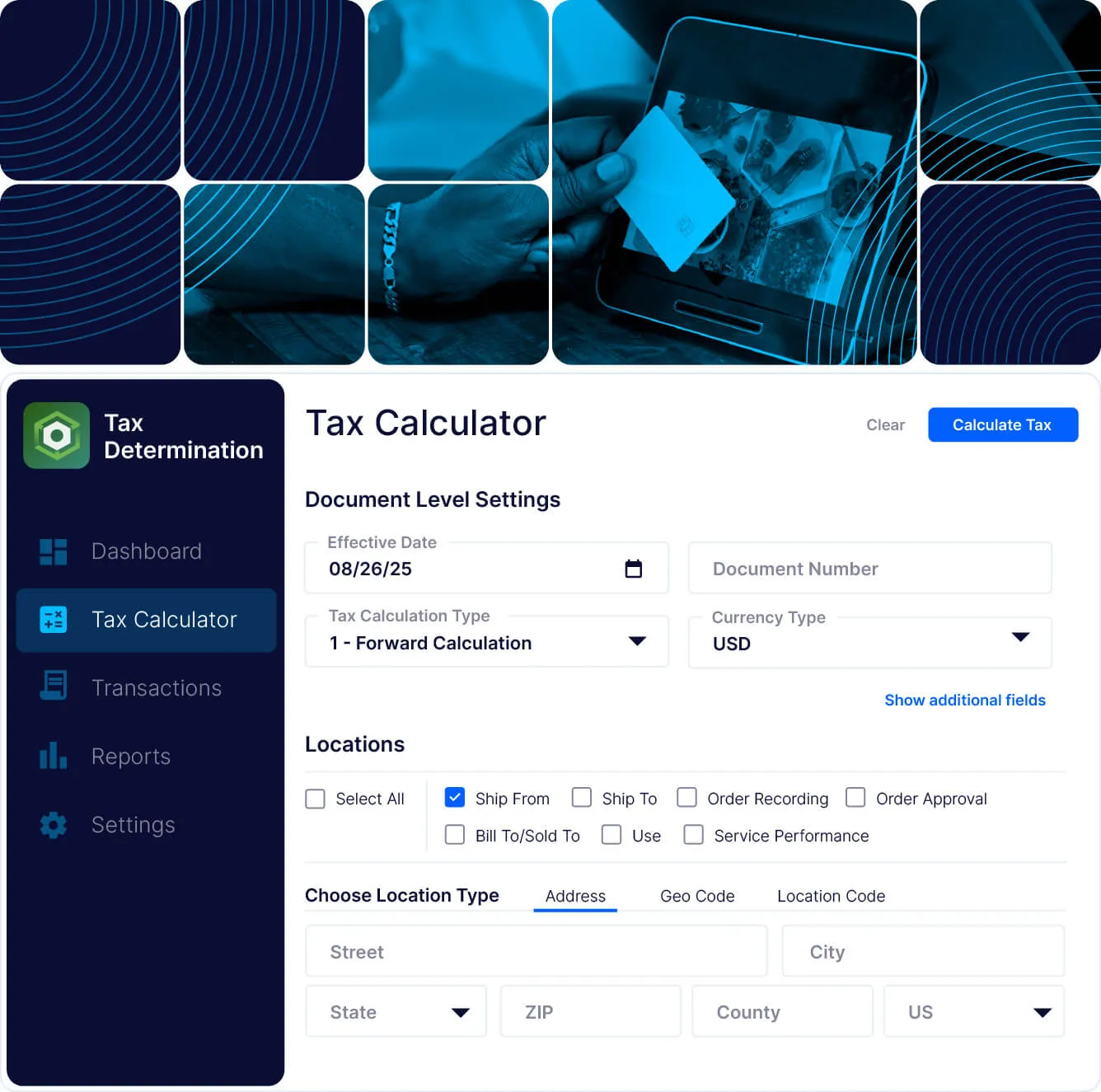

Real-Time Calculations

Provides instant tax determinations, enabling businesses to handle peak transactional periods without performance issues.

Enhanced Accuracy

Reduce errors in sales tax calculation, ensuring compliance with the latest tax laws and regulations.