From Complexity to Clarity

The Trusted Tax & Regulatory Reporting Solution for Mid-Market and Enterprise Organizations

Trusted by North America’s leading banks, healthcare providers, fintech companies, and Fortune 500 enterprises.

- SOC 2

- Enterprise-grade

- ERP Integration

- Backed by Global Compliance Cloud

“Sovos consolidated our 1099 and 1042-S processes, eliminated manual errors, and gave leadership real-time visibility before filings. We closed the year with confidence.”

VP Tax Operations

Reporting is harder, penalties are higher, and teams are stretched

Fragmented systems create blind spots. Manual checks slow payouts. State-by-state rules shift constantly. The result is missed forms, backup-withholding errors, and audit exposure.

Sovos unifies information reporting and withholding so you move fast—without risking compliance.

One place for U.S. federal, state, local and Canadian filings

Built-in validation prevents bad data from reaching tax authorities

Automated TIN matching and B-notice workflows cut penalties

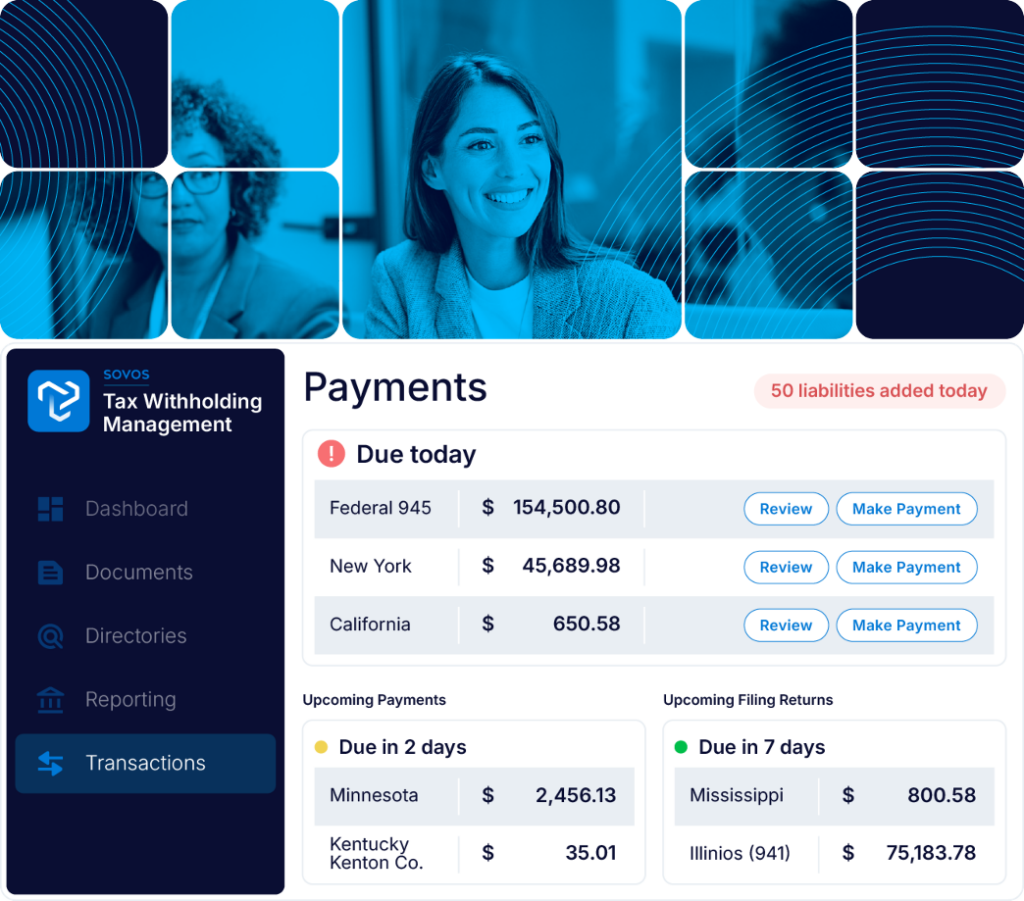

End-to-end withholding management with real-time reconciliation

Role-based dashboards for Tax, Payroll, AP, Finance and IT

Everything you need to report and reconcile at scale

Unified Information Reporting

Withholding & Reconciliatio

Manage backup and NRA withholding with clear rules and proofs. Reconcile payments vs reports without spreadsheets.

TIN Matching & B-Notice Automation

State & Local Filing Coverage

File to every required state and locality with up-to-date logic. Avoid mismatches between federal and state submissions.

Data Quality & Exception Handlin

Catch missing, invalid or duplicate records before they create penalties. Route exceptions to owners with context.

Enterprise Integrations & Security

Connect ERP, HCM and payment systems to Sovos. Rely on enterprise-grade security and audit trails built for regulated industries.

FAQ: Answers to your top questions

Can Sovos handle federal and state filing differences?

Yes — our suite maintains current rules and formats for IRS and every applicable state, ensuring consistent filings across jurisdictions.

How does it reduce B-notices and penalties?

By combining up-front TIN matching, data validation and automated B-notice workflows, we significantly cut error rates and penalty risk.

What integrations are supported?

Native connectors for leading ERP (HCM, AP, Payroll) and data platforms — batch or API — fit your existing architecture.

How is security handled?

SOC 2 certified controls, encryption in transit and at rest, and granular role-based access protect sensitive taxpayer data.

Take the complexity out of Trusted Tax & Regulatory Reporting Solution

Automate compliance, reduce risk, and reclaim time for strategic work.