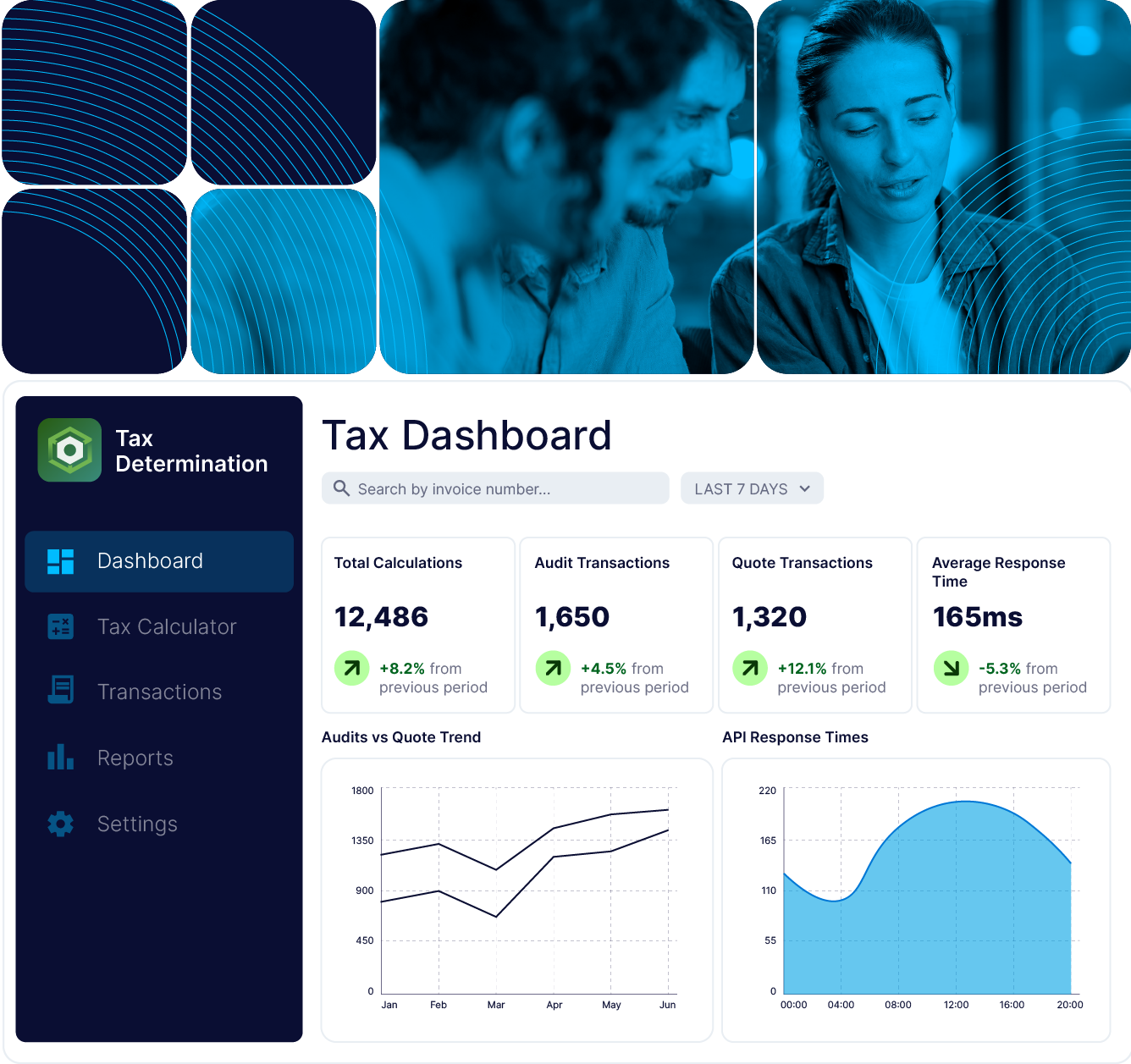

Why Sovos SAP Tax Determination?

Precise and Reliable

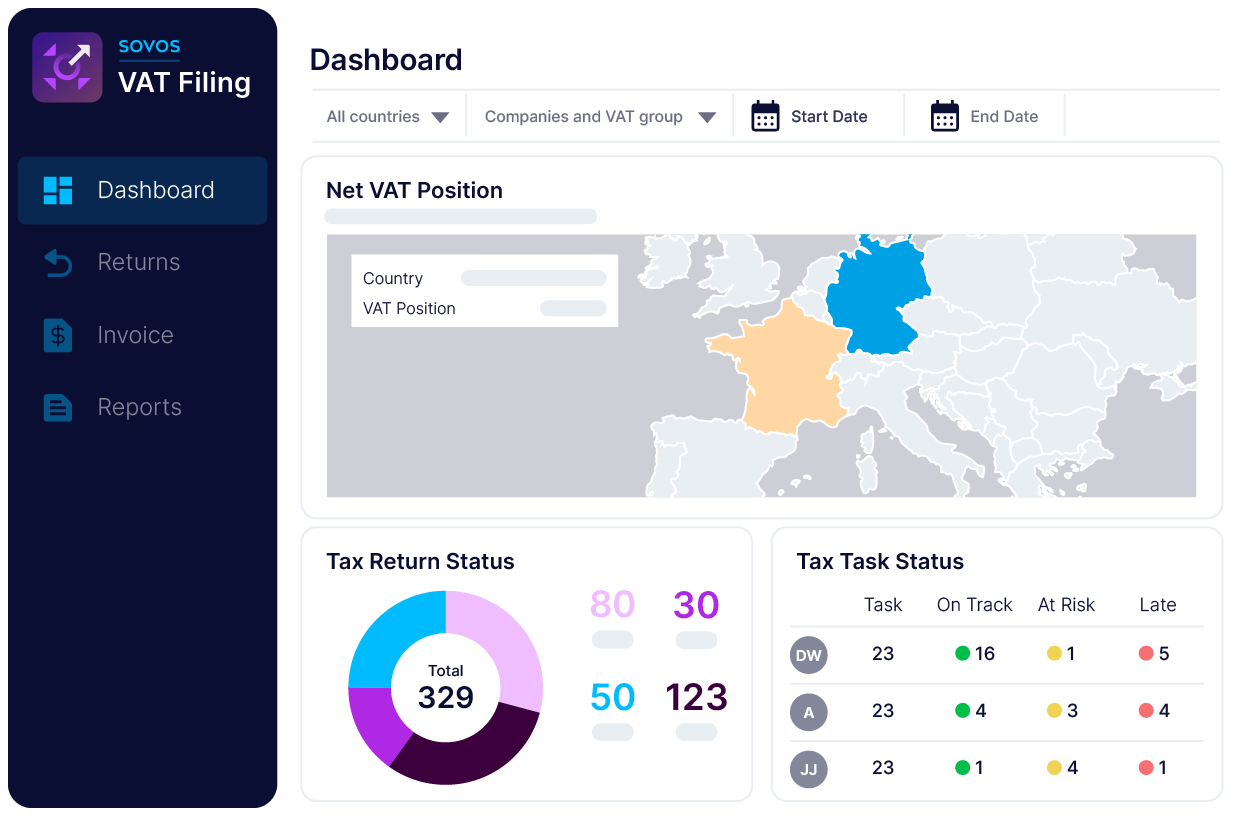

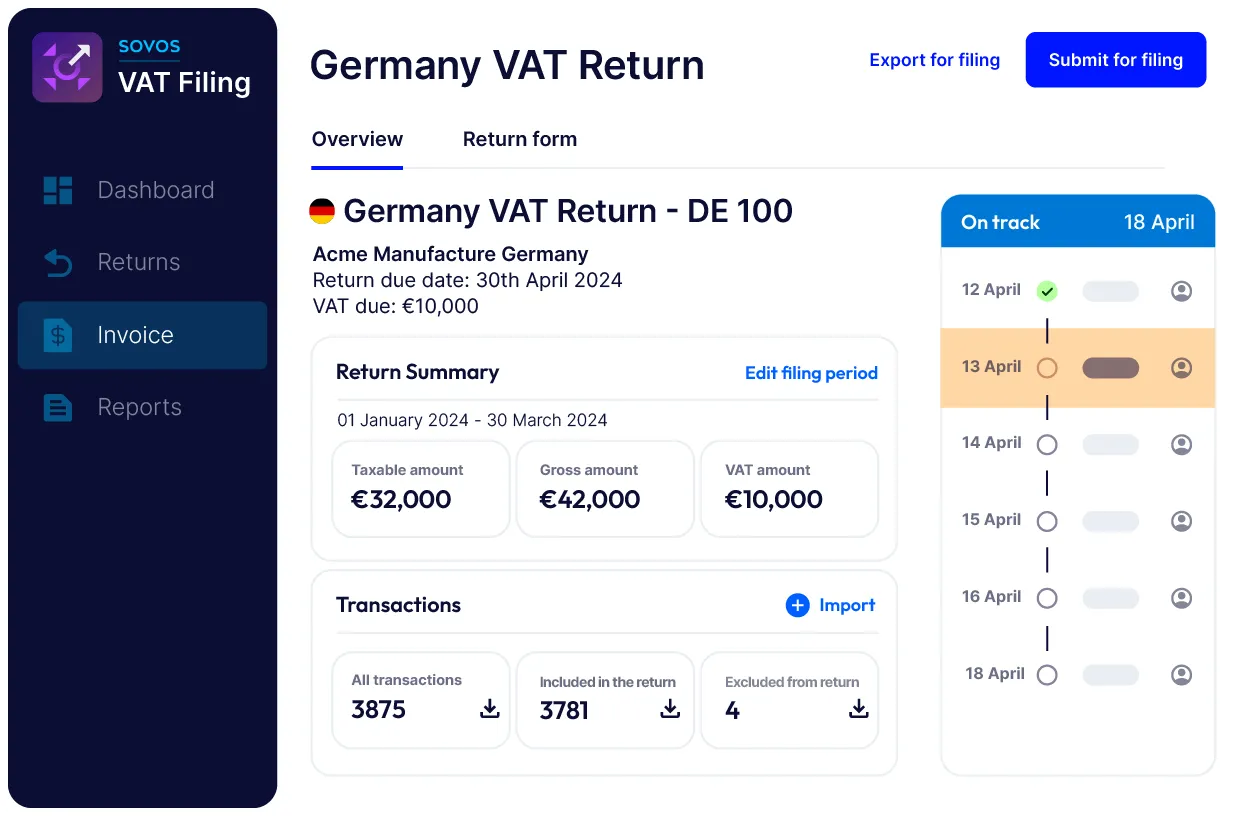

Automates VAT & GST determination for even the most complex supply chain scenarios resulting in reduced errors, streamlined tax workflows, time and cost savings and mitigated risk of non-compliance.

Seamlessly Integrated

Fully embedded in SAP environments for smooth workflows and minimal disruption.

Future-Proof Compliance

Enhances accuracy in e-invoicing, VAT returns, EC Sales Lists, Intrastat declarations, and SAF-T data, ensuring complete compliance with the evolving tax regulations and CTC mandates.