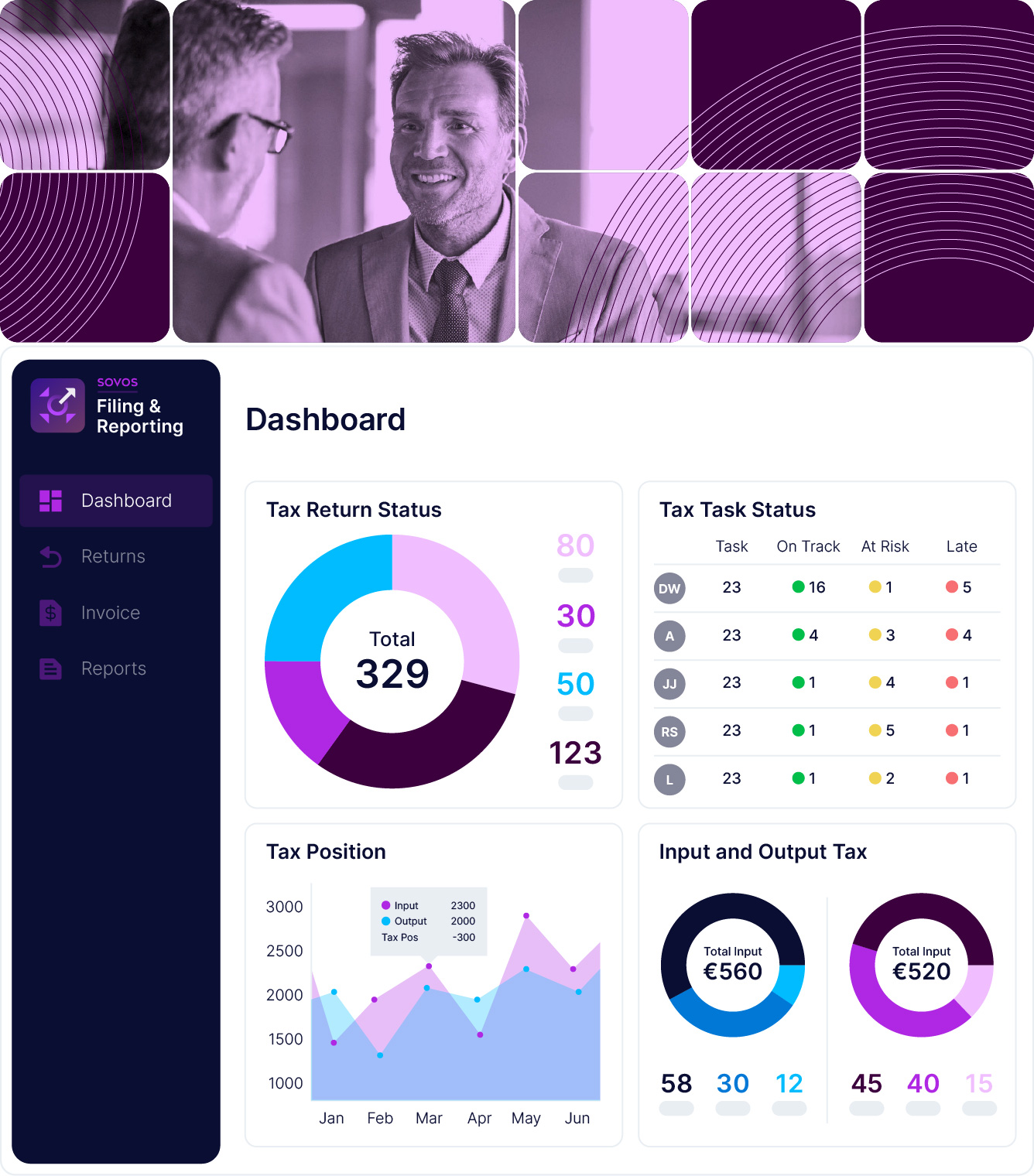

Automate corporate VAT return filing workflows

Why Sovos VAT Filing?

Global Coverage

Supports VAT filing of VAT Returns, Intrastat and EC Sales Lists in 64 countries, providing end-to-end compliance for multinational operations.

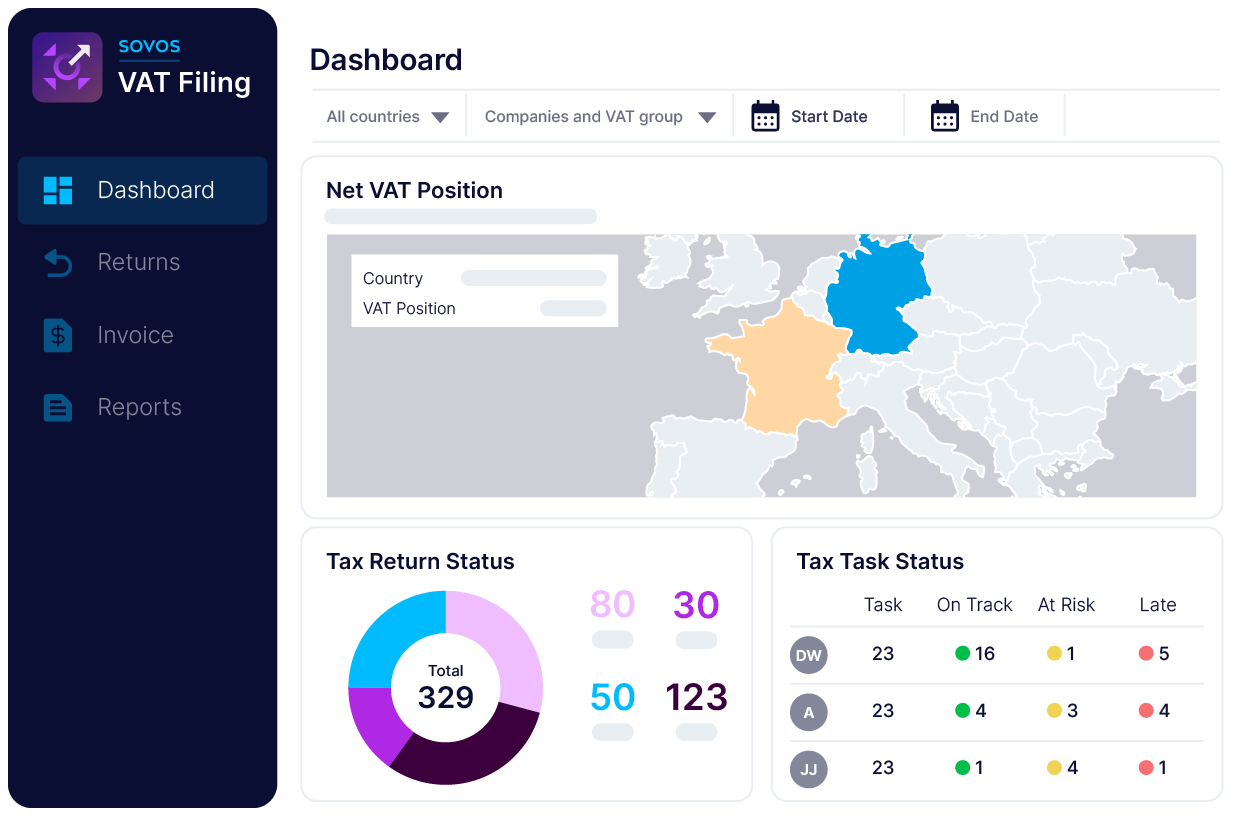

Advanced Analytics and Insights

Beyond simply automating reports, Sovos VAT Reporting provides deep analytics and insights into your VAT data, enabling you to make informed decisions and optimize your tax processes.

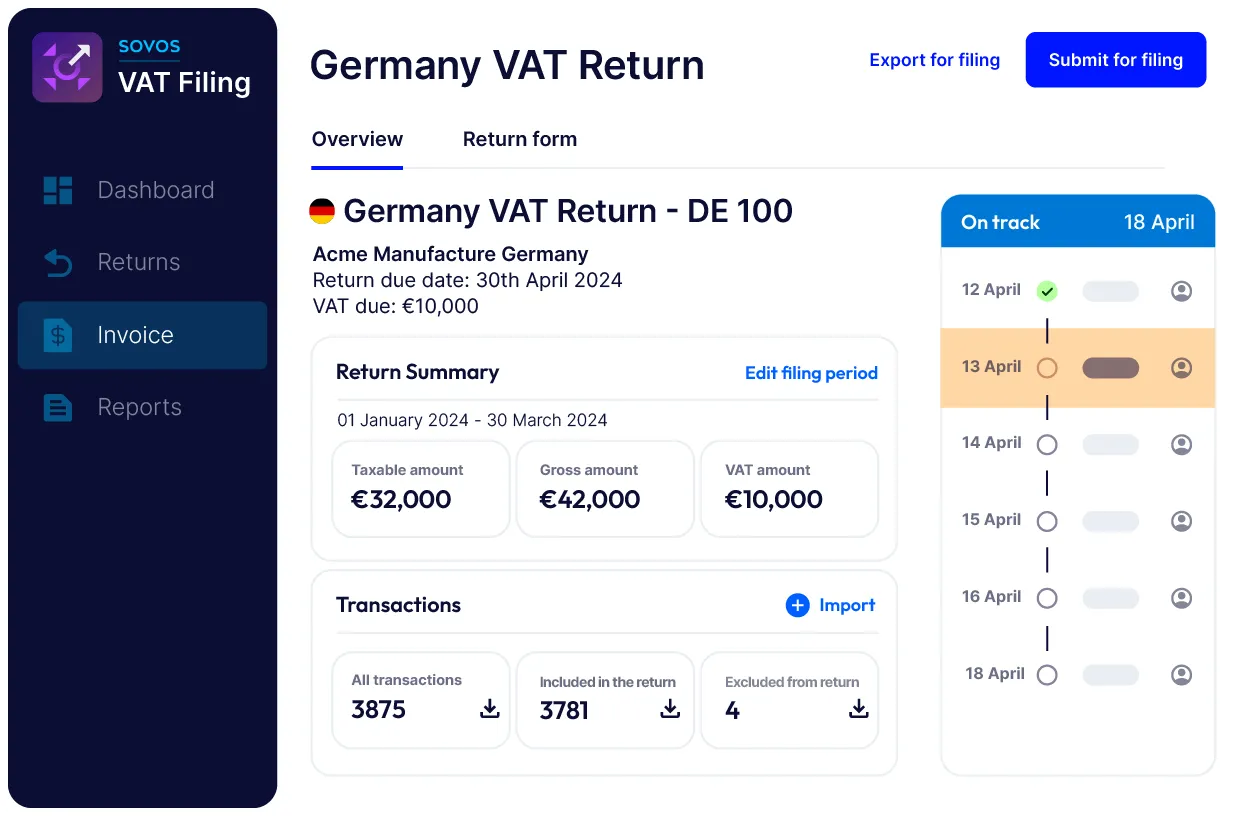

Effortless Automation

Automates VAT reporting and reduces manual intervention, freeing up your finance team.